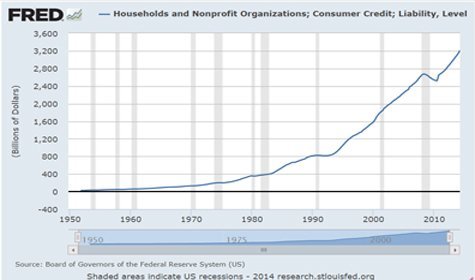

In aggregate Americans have done some minor repairs on their balance sheets. However, looking below the aggregates we find Americans getting less mortgage debt but even more consumer credit and credit card debt. Consumer debt peaked at almost $2.7 trillion during the Housing Bubble. This dropped back to about $2.5 trillion during the recession. However, since that lull in consumer borrowing consumer debt has expanded to $3.15 trillion. This represents a 25% increase since the recession and an all time high. Will American continue to borrow and spend this holiday season?

Consumer Credit Continues to Climb

:quality(75)/https://static.texastribune.org/media/files/ac4663e79b416628097ea59744969877/0418%20RGC%20Drought%20BL%20TT%2005.jpg?resize=440,264)